Home buying is a complicated process, but Mortgages For Champions has well rounded and knowledgeable employees, on stand-by, to help you through it!

Speak with one of our loan specialists for free! (888) 529-2831

Home buying is a complicated process, but Mortgages For Champions has well rounded and knowledgeable employees, on stand-by, to help you through it!

Speak with one of our loan specialists for free! (888) 529-2831

13

Why so unlucky…

Well, everyone has their own reason.

And I won’t get into which reason is the best.

Instead, let’s talk about the lucky ways 13 affects your mortgage balance.

Standard 30year Fixed Mortgage Repayment Schedule

You’ll make one payment a month, for 360 months. And each mortgage payment is split into two parts: a portion goes to your principal and the other to your interest.

Now the principal portion is applied to the amount that you owe the bank. This lowers how much you owe. The interest portion is your cost for borrowing from the bank.

As years pass, more the split goes to your principal and less to your interest. Yet, in the early years, most goes to pay your interest.

That’s why 5 years into your mortgage it will look like you haven’t paid off much (the fancy banking terms for this called your amortization schedule)…

But don’t worry, this is where old lucky 13 comes into play.

Bi-weekly Repayment Schedule

A bi-weekly repayment shortens your loan’s amortization schedule. Instead of taking 12 payments per year, you make 1 every two-weeks. Or 13 total payments per year.

Now, you can’t technically make 13 payments per year – that’s not how a mortgage works. Actually, you pay a certain amount of interest on an annual basis and that amount is covered in your first 12 payments. The 13th payment has to go somewhere.

So 100% of it gets applied to your principal balance (what you owe the bank). And, with each “13th payment”, your loan balance drops by the entire amount of the payment…

Which means you can slash many years off your mortgage. And save thousands of dollars in interest charges. Not bad, right?

I bet you’ll never look at 13 again the same way.

Article Written By:

Bruce Waller- Mortgage Loan Originator

NMLS # 1002298

(267) 362-4002

bwaller@rhfunding.com

The views and opinions expressed on this web site are soley those of the original authors and other contributors. This is not a commitment to lend. All rates, fees and loan terms are subject to a formal loan application, credit risk, appraisal evaluation and other lending criteria. Programs, rates, terms and conditions are subject to change without notice. Other restrictions may apply.

The annual New Jersey Education Association (NJEA) Convention was held in Atlantic City, NJ last week. NJEA was created to help those in New Jersey public education achieve excellence. The convention draws teachers and educational support professionals together to learn more in order to achieve their mission of promoting a quality system of public education for all students.

The annual New Jersey Education Association (NJEA) Convention was held in Atlantic City, NJ last week. NJEA was created to help those in New Jersey public education achieve excellence. The convention draws teachers and educational support professionals together to learn more in order to achieve their mission of promoting a quality system of public education for all students.

Residential Home Funding Corp. (RHFC) returned once again to exhibit at the convention and the turnout was incredible. “What a response we got. What great relationships we built and what a fun experience we had,” said RHFC Loan Officer Matthew Ziegert who was in attendance along with President Tom Marinaro, Loan Officer William Koedatich, and John Finkle Director of Mortgages for Champions.

The Mortgages for Champions Program from RHFC was developed as a special thank you to the heroes of our community and offers special discounts to teachers, firefighters, law enforcement officers, Doctors & Nurses: no application fee, no processing fee, no underwriting fee and no lender closing costs. Their booth at the convention educated teachers on this program.

The event was packed with attendees, and guest speakers included NJ teachers, local authors, and there was even evening entertainment including comedy and musical performances.

About Residential Home Funding

*Residential Home Funding Corp. was named on the list of the Top 100 Mortgage Bankers in America for the fifth time. This list is compiled by Mortgage Executive Magazine annually, ranking companies not only by their total volume, but also crediting them as “high performing” in periods of uncertainty. Founded in 2000, RHFC is a large mortgage lender that doesn’t act like one. As the 66th largest mortgage banker in America, they are licensed direct lenders in 12 states including CT, DC, DE, FL, GA, MD, NC, NJ, NY, PA, SC, and VA, while still treating each and every customer like family. RHFC funds all types of transactions such as basic residential purchases, refinances, investment properties, construction loans, mixed use, and more. Residential Home Funding Corp. is a direct FNMA lender and also originates FHA and VA loans to NJ and beyond. They are a direct FNMA lender and have LAPP approval. Their program is excellent for first time buyers allowing low down payments, gift money, and flexible underwriting standards on credit and debt to income ratios. At Residential Home Funding, there is a mortgage loan custom suited for almost every borrower, having built their reputation on service and efficiency. We Do Business in Accordance with the Federal Fair Housing Law. Visit Residential Home Funding Corp. at www.RHFunding.com. Minimum credit scores and maximum loan limits apply. Not all applicants qualify. RHF is an Equal Housing Lender. Certain products are not available in all states. Credit and collateral are subject to approval. This is not a commitment to lend. Program, rates, terms and conditions apply. Lender application, commitment, processing and underwriting fees waived. Borrower pays 3rd party fees including, but not limited to, title, appraisal and any points. Licensed Mortgage Banker: NMLS# 34973

Congrats! You are ready to move into your first home! However, you realize that a home is not a home without furniture! When you are furniture shopping, you may be worried about the cost of the items. However there are a few ways where the savings could add up.

New Items

Each month of the year, certain items go on sale due to the changing seasons or introduction of new models. Here is a handy list of what could be on sale each month:

Previously Owned Treasures

Second-hand furniture is a great way to furnish your new home for cheap. One place you can snag a deal is at your local garage and estate sales. You will find them around the spring and summer months. At those sales, you can find great items like dishes, flat wear, tables, lamps, and some furniture! Some of the items may be outdated, but it is always worth to take a look. Maybe vintage is your style!

Another great place you can look for pre-owned items are your local thrift stores. They are filled with hidden treasures and décor for your new home.

If online shopping is more your style, check out sites such as eBay, Amazon and LetGo app you can download to your smart phone.

DIY Savings

Sometimes when you do a DIY project, it can bring a personal element to your home without the price of a custom-made piece.

For example, a brand new coffee table can range from $100 to $200. However you can build your own (https://www.buzzfeed.com/carolineemiller/heres-how-to-create-the-perfect-table-for-any-wineaholic?utm_term=.oqwrAPgzd#.flRxaD58o) for cheap! This coffee table requires no power tools!

When you are trying to furnish your first place, furnishing your new home can be expensive. However, with these ideas, you can have a wonderful place and make it easy on your wallet.

Every year, National Mortgage Professional Magazine (NMP) announces its list of the top mortgage employers in the nation. They polled readers on their employers using the following criteria: compensation, speed, marketing support, technology, corporate culture, long-term strategy, day-to-day management, internal communications, training resources, industry participation, and innovation. Residential Home Funding Corp (RHFC) was named on this list once again.

RHFC prides itself on their personalized lending, competitive rates, and quick process. Those valuable company features paired with their passion for helping those is need is what has made their employees proud to be a part of a team that not only does a phenomenal job, but truly cares about its borrowers, its community, and its culture.

At RHFC, employees receive endless support, communication, and access to the most current technology. In-house and remote training is always available, a robust employee website is their central hub for on-demand resources, and company meetings include marching bands, celebrity speakers, and project runway inspired team building exercises.

To see the full January issue of National Mortgage Professional Magazine, click here: http://www.nxtbook.com/nxtbooks/nmpmedia/nmp_201701/#/54

About Residential Home Funding

*In 2016, Residential Home Funding Corp. was named on the list of the Top 100 Mortgage Bankers in America for the fifth time. This list is compiled by Mortgage Executive Magazine annually, ranking companies not only by their total volume, but also crediting them as “high performing” in periods of uncertainty. Founded in 2000, RHFC is a large mortgage lender that doesn’t act like one. As one of the largest mortgage bankers in America, they are licensed direct lenders in 12 states including CT, DC, DE, FL, GA, MD, NC, NJ, NY, PA, SC, and VA, while still treating each and every customer like family. RHFC funds all types of transactions such as basic residential purchases, refinances, investment properties, construction loans, mixed use, and more. Residential Home Funding Corp. is a direct FNMA lender and also originates FHA and VA loans to NJ and beyond. They are a direct FNMA lender and have LAPP approval. At Residential Home Funding, there is a mortgage loan custom suited for almost every borrower, having built their reputation on service and efficiency. We Do Business in Accordance with the Federal Fair Housing Law.

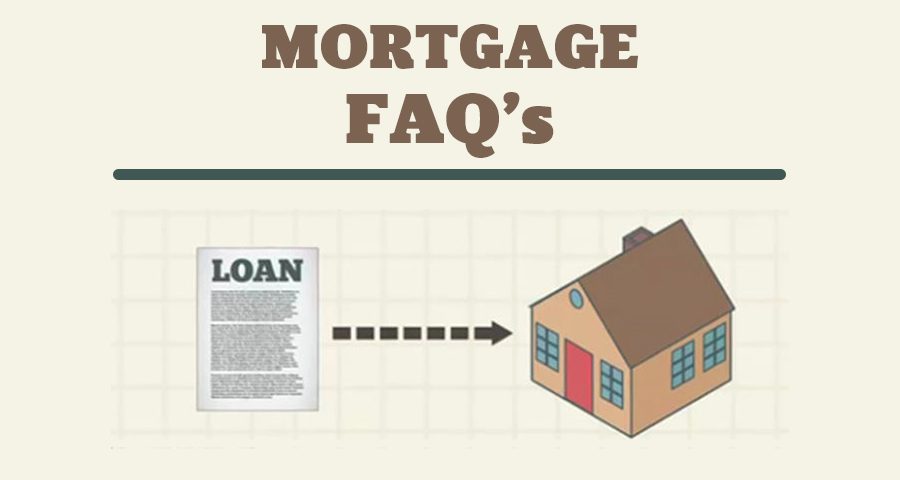

Everyone one, when they grow up, wants to buy a house or own property in their lifetime. However, like many people, you need to obtain a mortgage to buy a house unless you have half a million lying around your house. However, everyone has questions about their mortgage, from the down payments to the interest rate. Your mother might tell you that you are required to put down 20% or your buddy tells you that your interest rate isn’t as advertise from company XYZ. So to help clear up some confusion, here are some of the most common questions home buyers ask about mortgages.

”I heard you need to put down 20% for the down payment. How can I save that much?”

Here’s the fact: the gold standard for a down payment for a mortgage is 20%. However, if you don’t have that much in savings, there are still plenty of ways to buy a house and put down less than 20%. The Federal House Administration loan (FHA) allows borrowers to put down as little as 3.5% for your home. However, to qualify for an FHA loan, your credit score can be less than perfect and you need to show steady employment for at least two years. If you are an active or retired military member (or a surviving spouse of a veteran), a Veteran Affairs loan (VA) allows you to put 0% down for your home. There are some other workarounds too! Some states offer loan programs that enable borrowers with low income to receive a down payment subsidy.

“Why is my mortgage’s interest rate you are offering me is higher than the one you are advertising?”

Take a good look at that ad. If the interest rate is remarkably low with an asterisk, it will show a disclosure saying that is the best possible rate. To grab the BEST possible rate, you need to obtain a credit score of 750 and above and a low loan-to-value ratio, which means you are making a large down payment of at least 40% or more on the home price. If your borrowing scenario is not in the most perfect situation, you are considered more of a risk which will reflect your interest rate. Your interest rate will depend on your credit score, loan-to-value ratio, the loan amount, and the type of property you are buying like are you looking at single family houses or condos? So when you see an advertisement with a surprisingly low-interest rate, take a good look at the fine print when you evaluate your loan options.

“I heard the best option for me is a 30-year fixed-rate loan. Is that true?”

Just like clothing, there is no one size fits all when it comes to your loan options. For example, even though adjustable-rate mortgages (ARM) have a bad rap, they do make sense if you plan to move before the rates adjust. If you can’t afford a home with a fixed rate, ARM might be the best bet since fixed interest rate is slightly higher than adjustable-rate mortgages. However, a 15-year loan might make more sense than a 30 year loan if you can afford the bigger monthly bills. When you choose a 15 year loan, you will be paying far less interest than a 30 year in both time and the rate itself.

“What is private mortgage insurance and why am I required to have it?”

If you are putting down less than 20% on the home, you will have to pay private mortgage insurance or PMI. PMI is there just in case you are not able to pay your mortgage. When you don’t pay your mortgage, your lender will lose money, and that’s when PMI steps in. PMI is an extra 0.3% to 1.15% of your home loan. The sum can be large, but it makes sense if you want to buy a home now than later when you have 20% to put down. Still don’t like PMI? The other option is asking if your lender cover the mortgage insurance. The drawback? You will be paying a higher interest rate. Ask your mortgage consultant if paying PMI is cheaper in the long run than a higher interest rate.

Have any other questions we didn’t answer yet? Contact us at 973-577-7008 and we can find a licensed mortgage originator who can answer any questions you have.

Many Americans think that in order to buy a home, they would need to put at least 20% of the purchase price down for a down payment, not 0% or no money down. For example, if they want to buy a home with a $100,000 price tag, they would need to put down at least $20,000. I don’t know about them, but we certainly don’t have $20,000 lying around. Yet it is possible to save up for it over time. However, how long would it take for us to save up that much? Since it’s not that easy to come up with $20,000 overnight, or even in a year or two, the requirement for a down payment has drastically reduced. There are many loan programs out there that require as little as 3.5% of the purchase price as the down payment. Did you know that there are a few loan programs that have no down payment as a requirement? What loan programs offer something this crazy and we’ve never heard of?

VA loans are guaranteed by the U.S. Department of Veterans Affairs (VA) and require no down payment at all. The other plus side of this loan is that they do not require their borrowers to carry mortgage insurance as well. However, the downside of this loan is that they are very unpopular to many sellers, especially if you want to buy a home in poor condition. The VA standards are stricter than the average non VA loan because they want you to find a home in good shape. Also, this loan is only available to anyone who has served in the military as well as their surviving spouses.

Check out our video on VA loans here:

Liked the video? Visit our YouTube channel to subscribe, like, comment, and share more videos like it here

USDA loans are mortgages that are backed by the U.S. Department of Agriculture and are part of the USDA Rural Development Guaranteed Housing Loan program. Unlike a VA loan, USDA loans are available to everyone. One of the requirements of this loan is what location you are looking to be in. The property must be in a suburban or rural area, which means that you are restricted in a geographical area. You also must purchase a single family home that will occupied by you, and if you do not put down a down payment, you will be required to pay mortgage insurance as well.

If you are first time home buyer looking for no down payment, visit our Mortgages For Champions web site and take a look to see if you qualify for any of the loans offered. For more information, contact a licensed mortgage professional at 973-577-7008.

Picture this: you found your perfect house. You put in your offer and the seller accepts! Now it’s all about obtaining that mortgage to secure the deal. But did you know there are some mistakes you could be making that will affect your mortgage? We advise you to avoid the following:

Are there any other mistakes you shouldn’t make? Are you not too sure if you should do this or that? If you are lost and confused and want a professional answer, call us at 973-577-7008 and we can connect you to a mortgage loan originator who can help you avoid these costly mistakes.

We’ve all made some mistakes in the past with credit. Missing a payment here, being late on a payment there. Thanks to the Federal Housing Administration (FHA), you do not need to have perfect credit to buy a home. Did you know that half of all FHA home buyers today have scores below 680?

We’ve all made some mistakes in the past with credit. Missing a payment here, being late on a payment there. Thanks to the Federal Housing Administration (FHA), you do not need to have perfect credit to buy a home. Did you know that half of all FHA home buyers today have scores below 680?

The FHA mortgage program was launched in 1934 to help boost and stabilize the American housing market. In plain English, it means FHA makes it easier for people to qualify for a home loan compared to a conventional loan. A few advantages of a FHA loan are:

Thanks to some of these benefits and more, FHA loans will play a major role in the U.S. Housing Market. If you have a low score, be upfront about it and ask your mortgage loan originator. Some lenders will allow a score as low as 580, yet some have additional “investor overlays” requiring a credit score of 620 or higher. But are you curious on how your credit score is “created”?

Credit scores are a way to measure the risk of the applicant’s willingness to make timely payments on their loan. They are measured by risk. Consumers who pay their debts on time usually have higher credit scores than others. It can also be changed regarding how much you owe based on your credit card limits as well as any collections in your credit history. To this date, the FICO credit score is the most common system used by mortgage lenders, scores ranging from 300-850. So when it comes to mortgage approvals, lenders use the scores published by the three well-known, major credit bureaus – Equifax, Experian and TransUnion.

To learn more about your credit and FHA loans rates in NJ, call us at (973) 577-7008.

To budget your finance is to get an estimate of your income and expenditure for a set period of time. Like jeans, there is no budget plan that fits for all. Your friend’s budget might be different from yours. So how do you create a budget that is made just for you?

When you budget, you will be improving your financial situation and help you live the life you want to live! What are some of the “untouchables” in your budget? Did you try any of the tricks and it worked? Give us a call at 973-577-7008 and let us know!